Author Archive

What Will a Second Wave of Covid-19 Infections do to the Housing Market?

Covid-19 has drastically changed the world we live in, from the way we interact with each other to the way we buy and sell homes. After a plummet in mortgage rates the pandemic created an influx of home sales and a buying frenzy, decreasing the overall inventory for sale. However, as time has passed and another spike in coronavirus cases appears to be on the horizon, the buying bubble may have popped. Market experts predict a “W” shaped rebound for the months to come, and it seems that we are not yet out of the woods.

After the coronavirus initially hit the US, the unemployment rate shot up from 6.2 million in February 2020 to 20.5 million in May 2020. At the apex of about 14% of American’s were unemployed. However, as most US citizens have continued adjusting to new social distancing measures and more businesses continue to adapt and find ways to reopen, the Bureau of Labor Statistics has reported that “the unemployment rate has declined to 7.9 percent,” as of October 2nd, 2020.

Despite a worldwide pandemic and historically high unemployment rates, things for early fall housing markets looked to be on the up-and-up. Buyers continued to buy despite astronomically high prices on the homes that remained for sale in a very limited market, likely due to the inconceivably low-interest rates on mortgages. More businesses gave leniency to employees working from home, causing people to consider investing more into where they lived and had many fleeing their highrise rentals. Having children home from school 24/7 was also a key factor in pushing families to expand into bigger homes with bigger yards. If quarantining and social distancing would keep people in their homes, buyers were looking for a good place to hunker down and wait out the storm.

Though we’ve seen a significant drop in coronavirus cases since the initial arrival of Covid-19, as temperatures continue to drop, health experts anticipate another large resurgence in infections when the masses head indoors into confined spaces. Many cities have begun to pump the brakes on a full-blow reopening in fear of another drastic state-wide shutdown. So what’s to come for those still trying to buy and sell homes with a second strain of coronavirus infections predicted for winter? The possibility of another round of infections will have potential buyers examining their budgets and income with scrutiny out of fear of another series of mass layoffs. While sellers have enjoyed a very biased market and buyers have been taking advantage of low-interest rates, the late summer and early fall buying frenzy looks to be tapering off and flattening out. Realtor.com has predicted that the seller’s home price growth will flatten, with a forecasted increase of only 0.8 percent, while buyers’ mortgage rates are likely to rise to 3.88 percent by the end of 2020. Inventory will more than likely remain constrained, “especially at the entry-level price segment,” and a tight housing inventory paired with rising mortgage rates and fear of potential mass layoffs for buyers will lead to a significant drop off in sales. So if you’re considering making a move or selling your home, there is no time like the present!

Refinance Your Home Today! Here is Why…

Low Inventory in the Housing Market: A Seller’s Market

Covid-19 sent shock waves through the American Economy in March. The Wall Street Journal reported that some 30 million people lost their jobs amid the pandemic, and while businesses are slowly beginning to regain strength and momentum, some markets are at a stand-still. The housing market was one that took many economists by surprise, though. New buyers continued to enter the market despite travel bans and restrictions, so much so that now there is a severe shortage of homes for sale.

Even though travel, large gatherings, and open houses have been limited or banned, buyers have continued buying. But with mortgage interest rates at an all-time low and thousands in savings on loans, it’s hard to blame them! This, combined with more companies allowing workers to work remotely from home, has led to more and more young families and individuals moving away from large cities and metropolitan areas, looking to settle into more suburban ones.

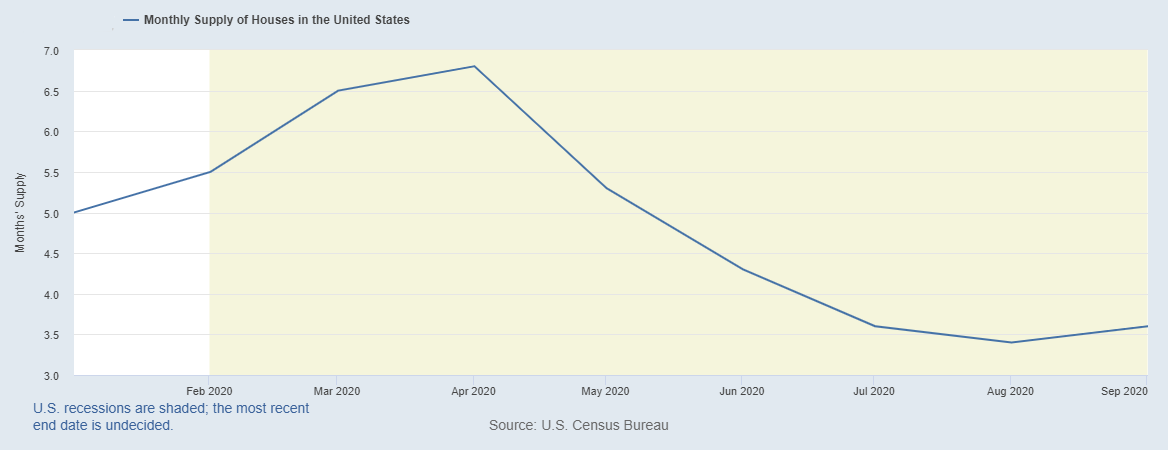

The shortages of homes for sale are not all the buyer’s fault. Many would-be-sellers have dropped plans to sell due to safety concerns, while others have lost their income source and cannot afford to move as they had planned. However, this inventory’s scarcity has shot the value of homes still for sale through the roof. Studies have shown that the median listing prices have grown 12.4 percent over the past year, which is the fastest-paced growth the economy has seen, surpassing the previous record held by 2016. As the growth in home value steadily increases, it is a seller’s market, at least for the time being. The senior principal economist at Zillow, Skylar Olsen, has predicted that while home sales will peak this fall, they will gradually decline through 2021. However, throughout the next year, sales volumes overall are expected to stay at higher percentages than the pre-covid markets saw.

It seems like for the time being, the market is favoring the seller, and while 2020 has been no one’s year, it may be the perfect year to sell your home for much more than you’d initially planned!